Balance-Sheet optimization:

The balance sheet is particularly important because it keeps you and other stakeholders informed of your financial position.

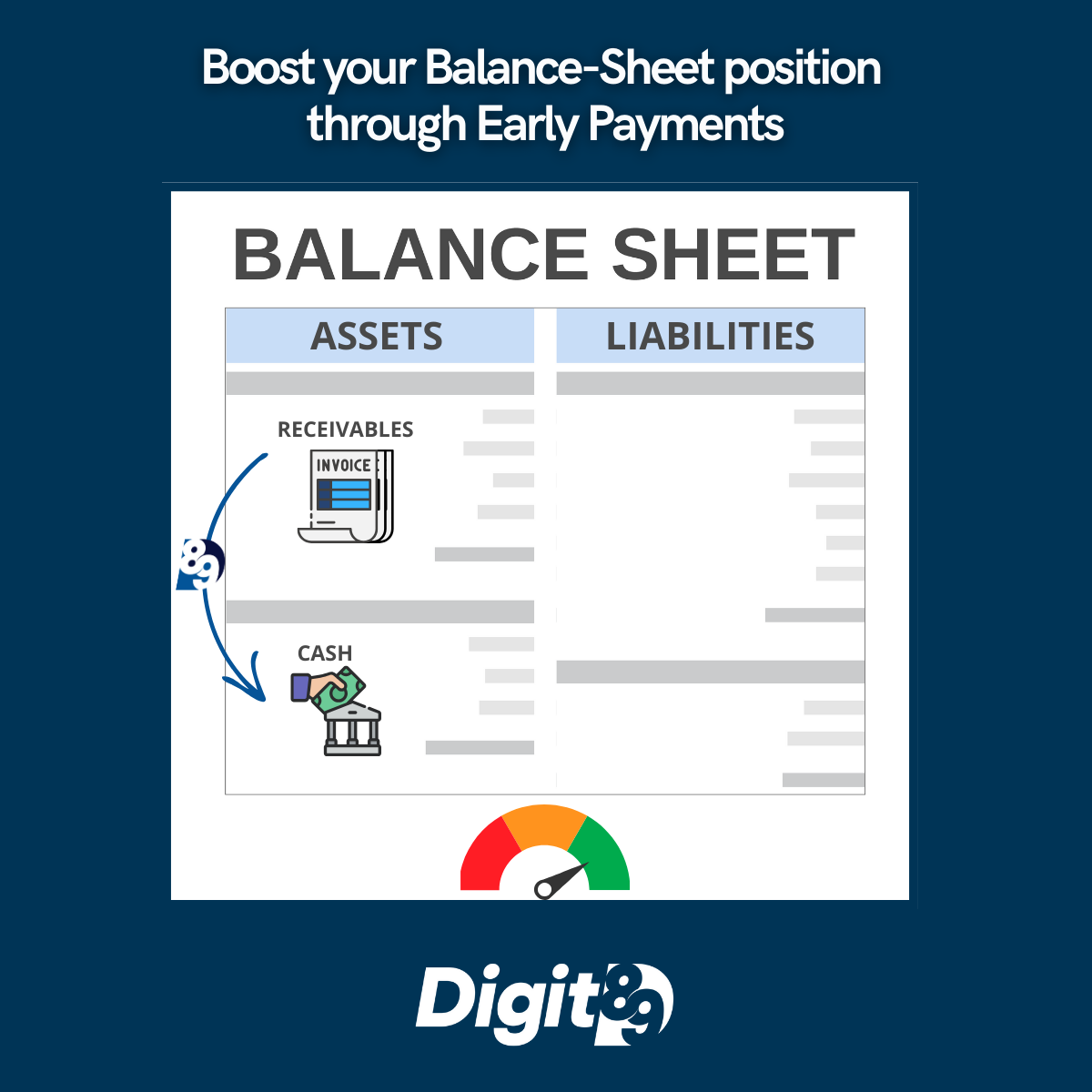

To improve your balance-sheet, the first step is to optimize the collection of your account receivables, thereby shortening your cash conversion cycle (measure by DSO, as explained below). Careful attention to the working capital position can strengthen the balance sheet, as cash, often referred to as ‘business oxygen’, is the most evidential sign of a strong balance sheet. Cash is indispensable for achieving short-term goals such as paying employees, trade payables and various other expenses.

However, presenting a strong cash flow-intensive balance sheet can be a challenge, especially if working capital is stuck in accounts receivable (AR). Prolonged payment terms pose ongoing challenges for suppliers driven by factors like rising inflation, interest rates and other market factors that lead clients to retain their working capital.

The good news is that there are ways to improve your payment cycles and improve your company’s metrics easily and efficiently. Digit89 empowers suppliers to convert their receivables into cash, as needed. On the Digit89 online interface, you can request the early payment of your choice in exchange for an affordable discount cost.

What is DSO “Days Sales Outstanding”?

Days Sales Outstanding (DSO) is a common measure for how long it takes a company to collect payment for an invoice. A higher DSO means it takes a company a lot longer to collect and could lead to cashflow problems due to the longer time between the sale and the time the payment is received.

To calculate DSO, divide accounts receivable by total sales in a given period, then multiply this number by the number of days in that period:

DSO = (AR balance/Total credit sales) x Days

As an example, if Supplier X accumulates €160,000 in accounts receivable and generates €900,000 in sales over a year, the DSO calculation would be:

⇒ DSO = (160K/900K) * 365 = 65 DSO

This means it takes, on average, 65 days to collect payment from customers after sales.

How to improve DSO?

1°Enhance Outstanding Invoices Management:

Managing outstanding invoices is crucial as clients are more likely to pay on time if you closely keep track of outstanding invoices (ensuring correct receipt and approval status, sending payment reminder, …).

Traditional methods involve regular client contact (by email or calls), but this proves ineffective and burdensome: Companies spend around 10 hours a week managing their outstanding invoices.

Fortunately, the Digit89 platform provides a total visibility into the treatment of your invoices by your clients. If your clients have joined Digit89, they automatically upload all their suppliers’ invoices data to Digit89. This affords you, as supplier, the opportunity to review your outstanding invoices and their status by simply logging into your Digit89 online interface.

2°Early Payment Solutions:

Early payment solutions are a cost-effective means to significantly reduce DSO while strengthening your customer relationships. Early payments will allow you to improve your Accounts Receivable and your cash flow by converting your account receivables into cash.

Digit89 facilitates this process, allowing you to choose which invoices to accelerate by simply logging into your Digit89 online interface. The selected invoices are paid immediately by Digit89 in exchange for a small discount cost (lower than a commercial discount).

Unlike traditional early payment approaches, this model enables suppliers to choose when to request early payment. This puts you in control of your DSO and increases cash flow at a much lower cost than other working capital solutions such as borrowing, lines of credit, invoice factoring or commercial discount.