The Unseen Drain on Europe’s Economy

Late payments are the silent killer of businesses, stifling innovation, employment, and growth. According to new data from Intrum, the situation is grim—European businesses are grappling with an ever-growing late-payments problem, and the situation has worsened in recent years. With rising inflation, government safety nets being withdrawn, and an increase in bankruptcy rates, late payments have evolved into a multi-dimensional crisis affecting the entire European economy.

The Statistics Are Alarming

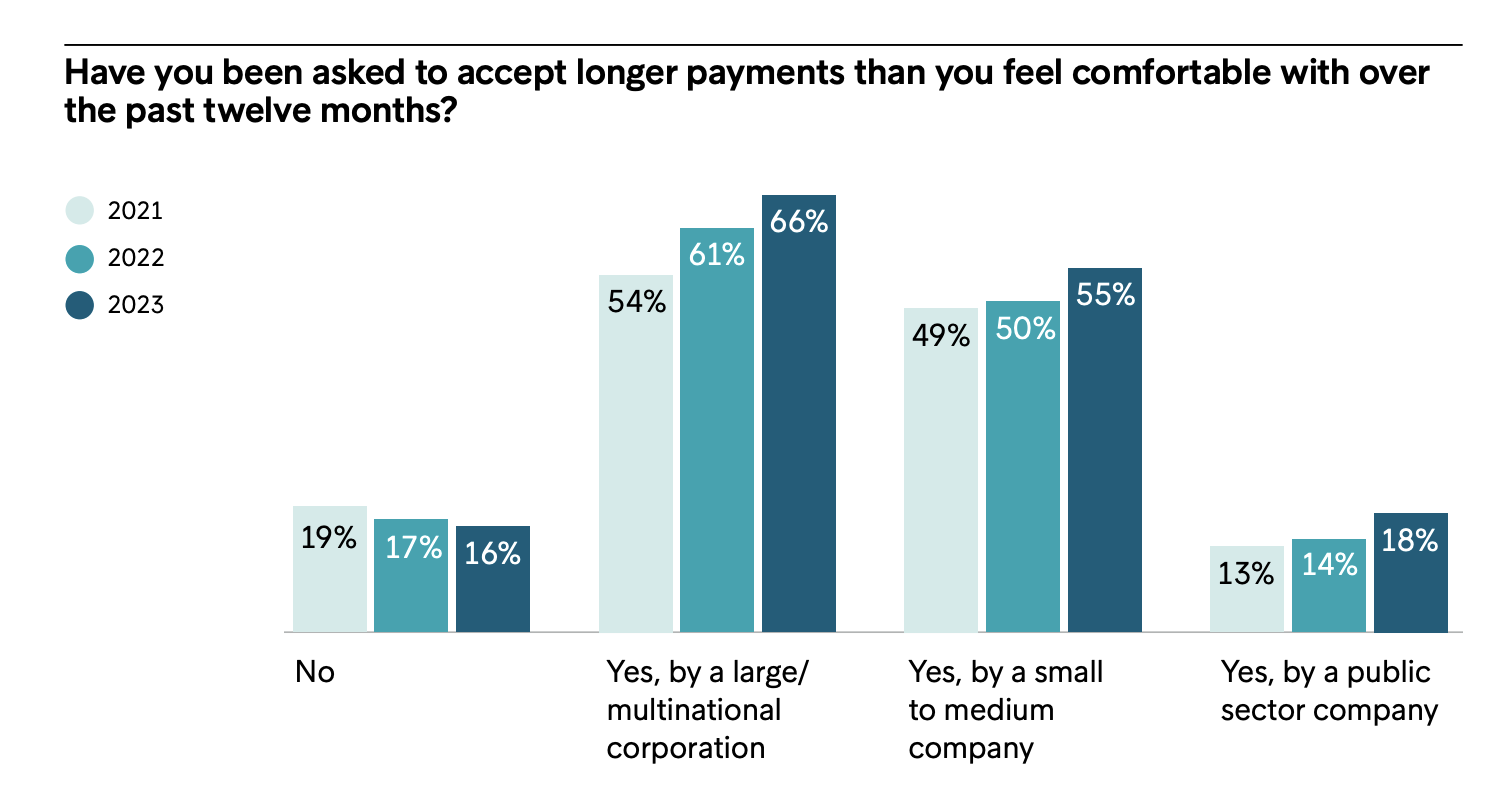

The percentage of businesses receiving extension requests on payments has increased significantly. In 2021, 54% of companies had received an extension request from a large company, and this figure has jumped to 66% in 2023. This problem isn’t just with large corporations. Smaller businesses are following the trend as well, with 55% extending their payment terms, up from 49% in prior years.

The Late-Payments Loop: A Chain Reaction

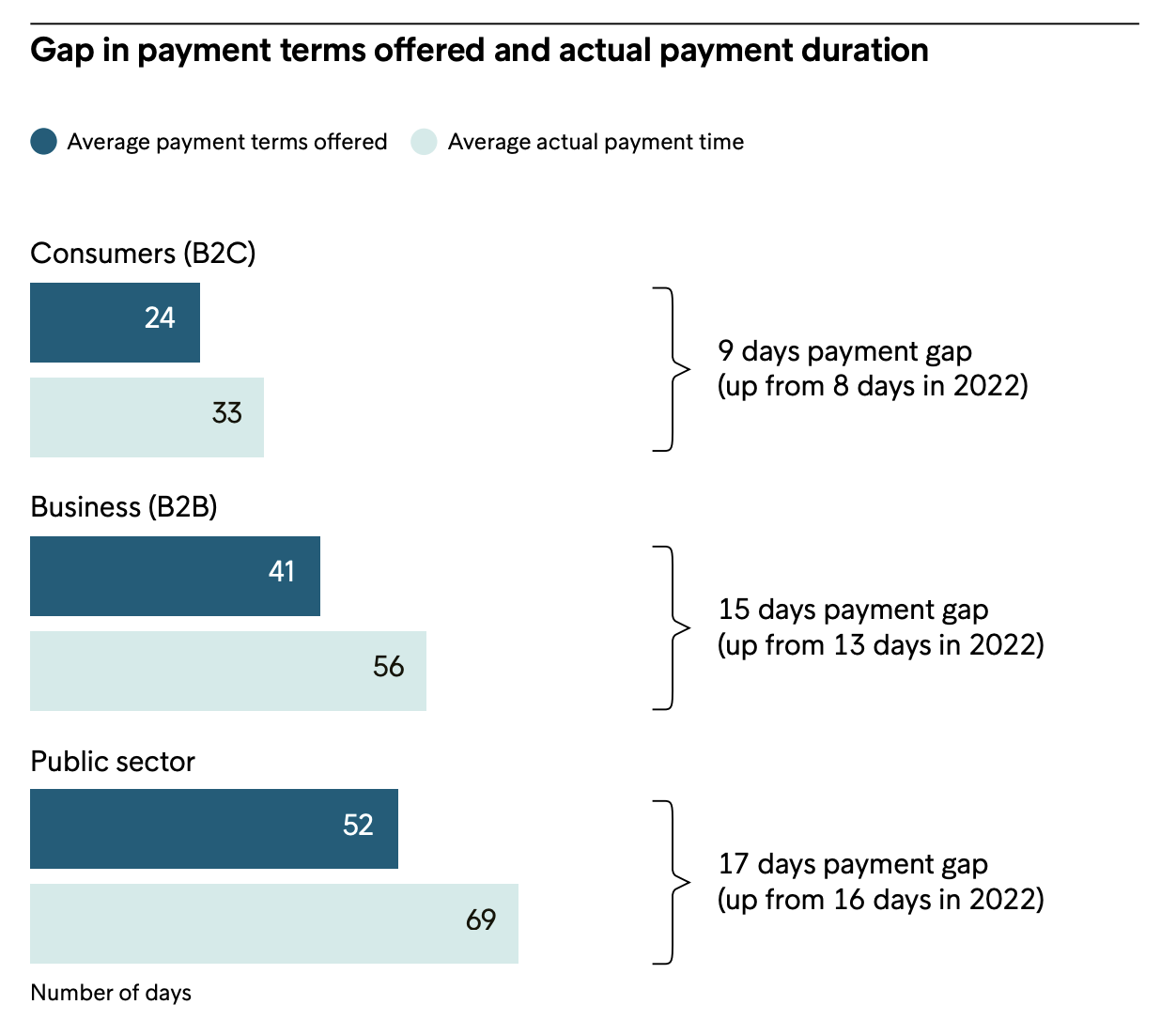

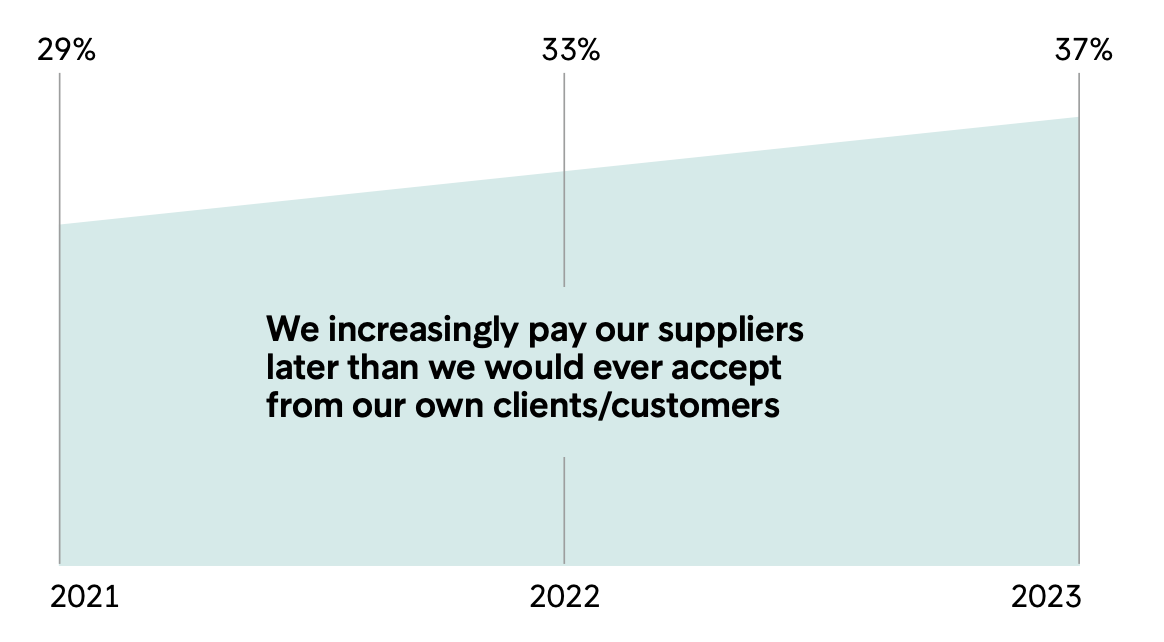

What’s particularly worrisome is the emergence of a ‘late-payments loop’ in B2B transactions. Businesses struggling with late payments from customers resort to delaying their payments to suppliers. This creates a dangerous domino effect that results in cashflow constraints and supply chain disruptions, weakening the resilience of the entire European economy.

Increasing Concern for Defaults and Bad Debt

Late payments can often slide into defaults, turning into irrecoverable losses. As per Eurostat, bankruptcy declarations reached a peak in Q4 2022. With 70% of businesses now claiming that credit losses are a significant issue for them, the problem can no longer be ignored.

Ethics and Accountability: A Way Forward?

Intrum’s research reveals an interesting correlation between businesses with a public code of ethics for timely payments and better payment behavior. Businesses that publicly commit to ethical payment practices are more likely to adhere to the set timelines, signaling that accountability plays a crucial role.

Steps to Break the Loop

- Automate Invoicing: Employ advanced invoicing software that minimizes human error and sends automated reminders.

- Ethical Codes: Implement and publicize a code of ethics around payment terms to hold your business accountable.

- Negotiation and Transparency: Be open about your payment terms and be willing to negotiate terms that are mutually beneficial.

- Legal Frameworks: Familiarize yourself with laws and frameworks, such as the European Late Payment Directive, to protect your interests.

- Financial Cushion: Maintain a cash reserve or a line of credit for financial stability.

- Efficient Early Payment Solutions: In today’s digital age, platforms like Digit89 offer a seamless connection to your clients’ accounting systems, allowing for the possibility of early invoice payments. This strategic move not only guarantees payments on the desired date but also relieves the stress of waiting and minimizes the administrative workload.

It’s time for a collective action plan. By combining a strategic approach with modern solutions and a commitment to ethical practices, we can all contribute to breaking this vicious late-payment loop and ensuring a stronger, more resilient European economy.

Sources: Intrum